Choosing a bookkeeping software for your Network Marketing Business

***This post may contain affiliate links, which means I may receive a commission if you make a purchase using these links, at no cost to you.***

So many options…so little time! This is true in so many areas of our lives and is no different when we talk about setting up the back end of your business. I know it can be frustrating and I am sure you are feeling it, so we are going to review the two software options that I recommend to my friends in Network Marketing and the clients that I work with directly!

In general, you want to utilize a software that allows for automation, is easy to understand, and allows for the proper output (or reports) that you need to make financial decisions. The two most important reports are the balance statement which indicates the value of your assets (what you own) and your liabilities (what you owe). And of course, the profit and loss statement, the total of your revenue and expenses for any given time period.

Let’s dive into my favorites – and trust me, you don’t have to have an accounting degree to understand these!

Wave

The best part about Wave – it is FREE. Yes, you read the right my friend, it is completely free! You cannot go wrong at this price point! They promise their software is 100% free with no trials or limitations. If you utilize the platform to invoice customers, they earn money off the processing fee of that transaction, which allows them to keep the software available for free.

Wave will integrate with most banks. I say most because there are still some small-town banks that do not allow connections to bookkeeping software. If you bank at with a small bank and determine they don’t allow for the connection, it is ok, there is a way to import your bank transactions to allow for smooth entry and reconciliation. (More on this at another time!)

Another awesome feature, even with the free version, is the ability to upload receipts to the software. No more file folders full of paper documents, they can live right within the software. And since the software is completely free – no need to worry about losing the documentation if you quit “paying”!

To check out more details on Wave and determine if this software is a good fit for you head to www.waveapps.com.

Quickbooks Online

Quickbooks online is a tad bit more advanced. It does everything Wave can do, but with the addition of many bells and whistles. Quickbooks is also one of the most widely used bookkeeping softwares among bookkeepers, tax professionals, and even CPAs.

The pricing structure and offerings can get a tad bit confusing, so here is my suggestion. Of the 4 subscriptions they offer – stick with either Simple Start or Plus. The self-employed version does not provide enough customization to properly setup your chart of accounts nor the ability to track inventory. If you want the ability to track inventory digitally within your bookkeeping software, Quickbooks Plus will give you that ability!

Starting with Quickbooks is also a good option if you plan to scale your business. While Wave is a good starter option, the bigger your business gets, the more comprehensive of a solution you will need for automation, expense tracking, reporting, etc.

Moving from one software to another can be very time consuming and cause many headaches. And, being in network marketing can lead to an inventory headache. Keeping proper track of your inventory can be done very easily inside of Quickbooks and allow for a much better financial review at any given time.

Click here to review Quickbooks offerings and determine which subscription level will best fit your business and needs!

I hope this overview helps you to make a well-educated decision in choosing a bookkeeping software for your network marketing business!

Need help on putting together your chart of accounts? Check out this blog post on determining the right accounts for your documentation - https://bit.ly/38GRyRh

Be sure you are part of our Facebook community so you can get daily tips and tricks as well as participate in our weekly Q & A’s! Join here - https://bit.ly/32JoFjt

xo - Britt

Tracking business expenses in your small business

Knowing and understanding how to properly account for expenses in your business can seem a bit scary. The task of doing so can seem tedious, but it is a necessity in order to have a true reflection of your business’ financials. And, of course they are necessary for tax time!

Today we are only discussing expenses outside of what you would consider inventory or merchandise that you plan to resell. Expenses such as marketing, office, supplies, travel, meals, etc. Since these expenses are not part of what you are reselling, paying sales tax according to your state’s laws is necessary.

There are many different ways to track expenses, today we are going to talk about manually tracking expenses using a spreadsheet. I even have a freebie for you to jump start the frame-work of your expense tracking!

Creating a Chart of Accounts (COA)

Deciding what accounts or categories to enter your expenses in depends a lot upon what information you want to see as a business owner. This can be difficult to determine when you are just starting out. But, your chart of accounts (COA) can evolve over time, and that is okay!

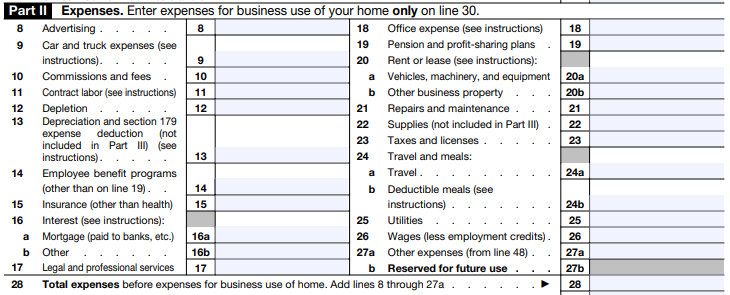

I suggest starting out with categories that align with the IRS Schedule C form. This is the form that is completed at tax time as the profit and loss statement for your business. (If your business has been structured as sole proprietorship, LLC, or partnership. More on this at another time!)

Here is what the expense section looks like on that form. As you can see, there are many expense categories that make sense, but there are some that will not apply in your business, at least not right away. There is also a line for “other expenses”, details are required further down in the form. So, if you have an expense category that doesn’t really fit into these, that doesn’t mean it isn’t a business expense and it can be listed as a separate item.

In manual tracking, in order to create a COA, just create columns on a spreadsheet or a tab for each category. Again, it is really up to you how you want to document this information. The important part is that documenting actually happens!

Entering Expenses Manually

Now comes the fun part! Taking the information from your receipts and/or invoices and entering them into the spreadsheet. Once you have decided how to format your spreadsheet, this part is pretty simple.

Enter the date, the vendor/store, and the dollar amount of the receipt into the category it most aligns with. Let’s say you pay for a planner and some pens at Office Max. This planner is to be used in your business to keep track of your daily tasks and you needed some new pens as well. Both of these products would be considered office expenses. Below is an image of how the entry would look in your expense spreadsheet.

It’s not so hard, right? You may find things are a bit more complicated when you have a receipt that has multiple products on it that belong in multiple categories. Don’t worry! I am going to walk you through it!

For this example, we are going to use an Amazon receipt that includes envelopes and a set of sample jars that I am going to use to send samples to potential customers. I will want to separate each product into different categories. Here is the calculation to use if you have been charged sales tax:

Item amount x Sales tax rate = total expense

Calculate this amount for each product, double check they add up to the total of your receipt and enter them into your spreadsheet as shown below. I suggest writing the amount on the receipt and the category that you placed each product in so if you ever need to reference back you know what you did.

Be sure to add a total line underneath all of your expenses, this is the amount that will be transferred to your tax return.

I hope this helps to understand how to enter your expenses and how this process will help keep you organized. Be sure to keep copies of your receipts, either digitally or in a file folder, whatever is easiest for you. You also need to create a new sheet for each year, never keep a running tally of every year in the same spreadsheet. Your taxes are only for the calendar year.

To help you get started, I have created a basic business expense tracker and it can be yours - totally free! Click here and it is all yours!

Next week we are going to discuss digital tracking! My favorite! Be sure to join me in my Facebook group for even more resources and lots of training! Click here to join!

Xo,

Britt