Tracking business expenses in your small business

Knowing and understanding how to properly account for expenses in your business can seem a bit scary. The task of doing so can seem tedious, but it is a necessity in order to have a true reflection of your business’ financials. And, of course they are necessary for tax time!

Today we are only discussing expenses outside of what you would consider inventory or merchandise that you plan to resell. Expenses such as marketing, office, supplies, travel, meals, etc. Since these expenses are not part of what you are reselling, paying sales tax according to your state’s laws is necessary.

There are many different ways to track expenses, today we are going to talk about manually tracking expenses using a spreadsheet. I even have a freebie for you to jump start the frame-work of your expense tracking!

Creating a Chart of Accounts (COA)

Deciding what accounts or categories to enter your expenses in depends a lot upon what information you want to see as a business owner. This can be difficult to determine when you are just starting out. But, your chart of accounts (COA) can evolve over time, and that is okay!

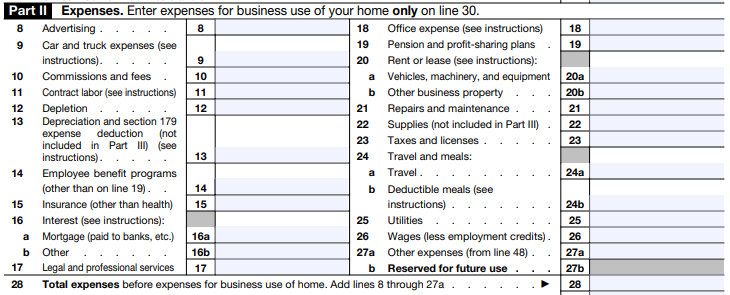

I suggest starting out with categories that align with the IRS Schedule C form. This is the form that is completed at tax time as the profit and loss statement for your business. (If your business has been structured as sole proprietorship, LLC, or partnership. More on this at another time!)

Here is what the expense section looks like on that form. As you can see, there are many expense categories that make sense, but there are some that will not apply in your business, at least not right away. There is also a line for “other expenses”, details are required further down in the form. So, if you have an expense category that doesn’t really fit into these, that doesn’t mean it isn’t a business expense and it can be listed as a separate item.

In manual tracking, in order to create a COA, just create columns on a spreadsheet or a tab for each category. Again, it is really up to you how you want to document this information. The important part is that documenting actually happens!

Entering Expenses Manually

Now comes the fun part! Taking the information from your receipts and/or invoices and entering them into the spreadsheet. Once you have decided how to format your spreadsheet, this part is pretty simple.

Enter the date, the vendor/store, and the dollar amount of the receipt into the category it most aligns with. Let’s say you pay for a planner and some pens at Office Max. This planner is to be used in your business to keep track of your daily tasks and you needed some new pens as well. Both of these products would be considered office expenses. Below is an image of how the entry would look in your expense spreadsheet.

It’s not so hard, right? You may find things are a bit more complicated when you have a receipt that has multiple products on it that belong in multiple categories. Don’t worry! I am going to walk you through it!

For this example, we are going to use an Amazon receipt that includes envelopes and a set of sample jars that I am going to use to send samples to potential customers. I will want to separate each product into different categories. Here is the calculation to use if you have been charged sales tax:

Item amount x Sales tax rate = total expense

Calculate this amount for each product, double check they add up to the total of your receipt and enter them into your spreadsheet as shown below. I suggest writing the amount on the receipt and the category that you placed each product in so if you ever need to reference back you know what you did.

Be sure to add a total line underneath all of your expenses, this is the amount that will be transferred to your tax return.

I hope this helps to understand how to enter your expenses and how this process will help keep you organized. Be sure to keep copies of your receipts, either digitally or in a file folder, whatever is easiest for you. You also need to create a new sheet for each year, never keep a running tally of every year in the same spreadsheet. Your taxes are only for the calendar year.

To help you get started, I have created a basic business expense tracker and it can be yours - totally free! Click here and it is all yours!

Next week we are going to discuss digital tracking! My favorite! Be sure to join me in my Facebook group for even more resources and lots of training! Click here to join!

Xo,

Britt